- Smart X Capital

- Posts

- How to Profit from America’s Collapse 📉

How to Profit from America’s Collapse 📉

America's global dominance entering decline phase ⚠️

TLDR

🚨 We’re exiting empire peak, entering decline—debt, inflation, and division signal the next global power shift.

🧠 History doesn’t repeat—it sings in cycles. Study them to unlock timing, positioning, and asymmetric advantage.

💰 Cash is trash in decline. Convert to assets that hold value

🌍 Sovereignty is the new wealth—diversify income, skills, and geography before the system reshuffles the board.

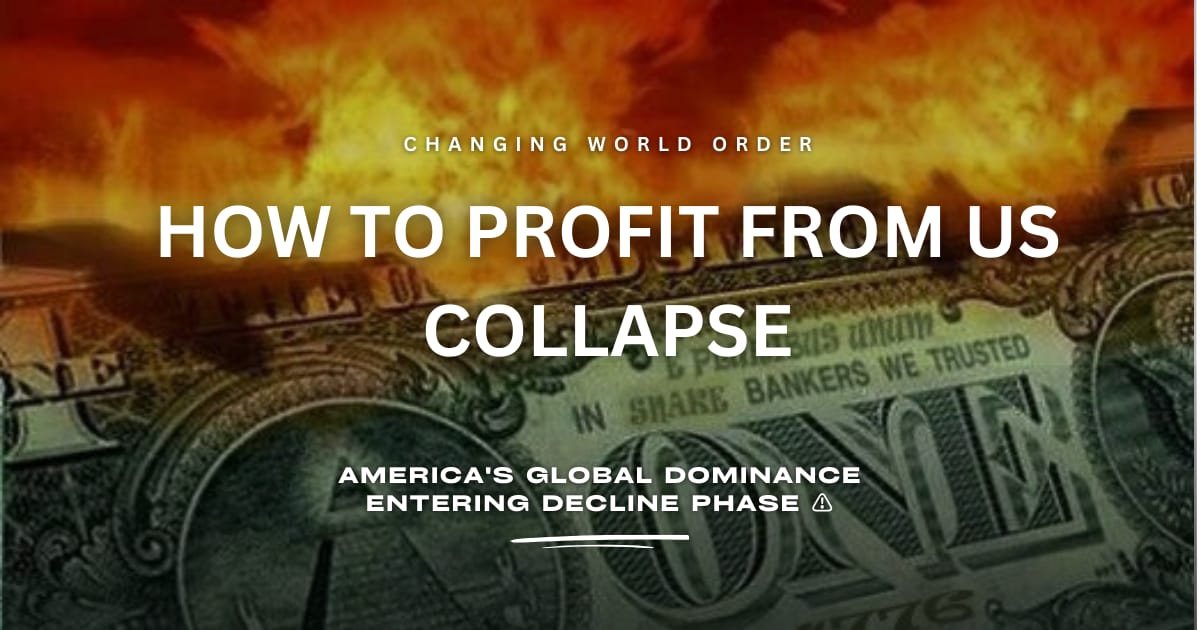

The Reality of Big Cycles

We are not where we think we are — we're in the middle of a historic transition, and most of us are asleep at the wheel.

Over the years, I’ve realized the world works in patterns. Civilizations, economies, and empires all rise, peak, decline, and collapse—over and over again. These are what Ray Dalio calls “The Big Cycles,” and whether you like it or not, we’re deep into one now.

What surprises people the most about cycles is how obvious they are—after the fact. And that's exactly the point. Most are caught off guard because they're focused on the present. But in order to anticipate the future, you must look to the past. That’s how serious investors, power players, and nations navigate downturns and position themselves during the chaos.

Let me show you how it works.

What is a “World Order” and Why It Matters

A world order is the established structure of governance, finance, and power both within a country and globally. These orders determine how nations interact and compete. But here's the key—these systems are fragile, and they change violently when the balance tips.

Internally, empires have constitutions and laws. Globally, treaties and agreements set the rules between powers. But none of these are permanent. They function only so long as the dominant empire can enforce or inspire respect. Once that strength weakens—through debt, overextension, or internal division—the order breaks.

The 3 Forces Driving Our Current Shift

Ray Dalio breaks it down into three key forces that fuel the transition from one world order to the next—and all three are happening right now:

🔥 Not Enough Money: Governments are drowning in debt. Central banks are forced to print money rather than tighten. This happened in 1971 under Nixon and again in 2008 and 2020. Every instance devalues currency, causes inflation, and floods capital into hard assets like stocks, gold, and real estate.

🧨 Internal Conflict: Rich vs poor. Left vs right. The wealth gap fuels anger and extremism. Political systems degenerate into polarization, populism, and eventually chaos.

⚔️ External Conflict: A rising power (China) challenges an established empire (United States). History shows this almost always leads to war. Empires do not decline peacefully.

History Doesn’t Repeat—It Rhymes

Ray analyzed the Dutch, British, American, and Chinese empires over the past 500 years. What emerged was a consistent cycle of rise, peak, and decline. Here’s how those stages break down.

The Rise

🧠 Education First: Smart nations educate their population in knowledge, values, and hard work.

💡 Innovation: That education fuels new technologies and systems, which scale up productivity.

📈 Economic Output: As output rises, trade explodes and wealth floods in.

🛡️ Military Strength: Empires protect trade with force. Economic power backs military dominance.

💵 Reserve Currency: The empire’s currency becomes the world’s store of value. This unlocks a key power—endless borrowing.

💰 Capital Markets: Financial centers grow. Investment surges. Wealth expands rapidly.

But here’s the paradox: the very traits that lead to success sow the seeds of decline.

The Peak

🎭 Decadence and Laziness: Prosperity leads to softness. New generations become entitled and lose the hunger that built the empire.

🤑 Financial Bubbles: Easy money fuels speculation. Borrowing explodes. Everyone bets the good times will never end.

💔 Huge Wealth Gaps: Rich get richer and protect their power. Poor get left behind and grow angry.

📉 Productivity Declines: Division rises. Institutions decay. Empires lose their competitive edge.

The Decline

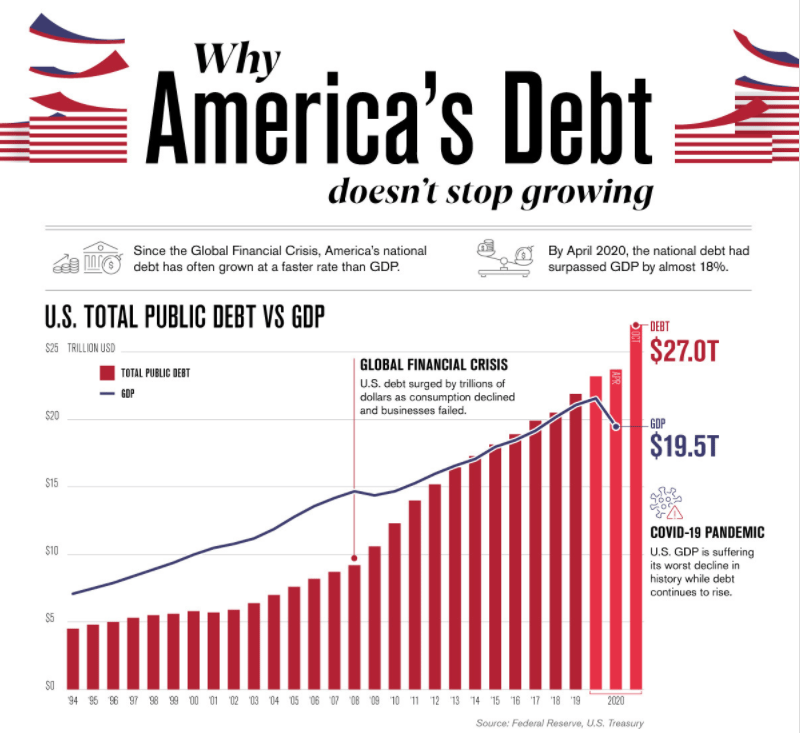

📉 Massive Debt: Empires borrow from poorer nations to stay afloat—like the US borrowing from China.

💵 Print or Default: Eventually, they must choose between default or printing money. Always, they print—causing hyperinflation and currency collapse.

🚨 Political Extremism: Society fractures. Extremists on both sides rise. The middle vanishes.

💥 Civil Wars, Revolutions: Internal unrest erupts. Some revolutions are peaceful; others are violent.

⚔️ External Conflict: Sensing weakness, rising powers strike. War redistributes global power.

Where We Are Today

Based on Ray’s framework—and my own observations—we’re exiting the peak and entering early-stage decline. All the signals are flashing:

⚠️ US debt is at historical highs; spending far exceeds revenue.

⚠️ Dollar strength is decaying, although not yet collapsed.

⚠️ Inflation is structural, not transitory. Asset bubbles persist.

⚠️ Political division is no longer argument—it’s animosity.

⚠️ China is rising technologically, economically, and militarily.

And here’s the point you need to understand.

Those who’ve studied previous transitions – from Dutch to British to American dominance – know that the shift is chaotic. Fortunes are destroyed, families uprooted, systems reset. But. To those who understand it, these shakeups are the best times to gain massive leverage.

Cycles As Opportunity

When the rules of the game are changing, don’t play by the old rules.

🪙 Convert Cash to Productive Assets: Paper money loses value when empires decline. Buy real assets: commodities and non-volatile real estate.

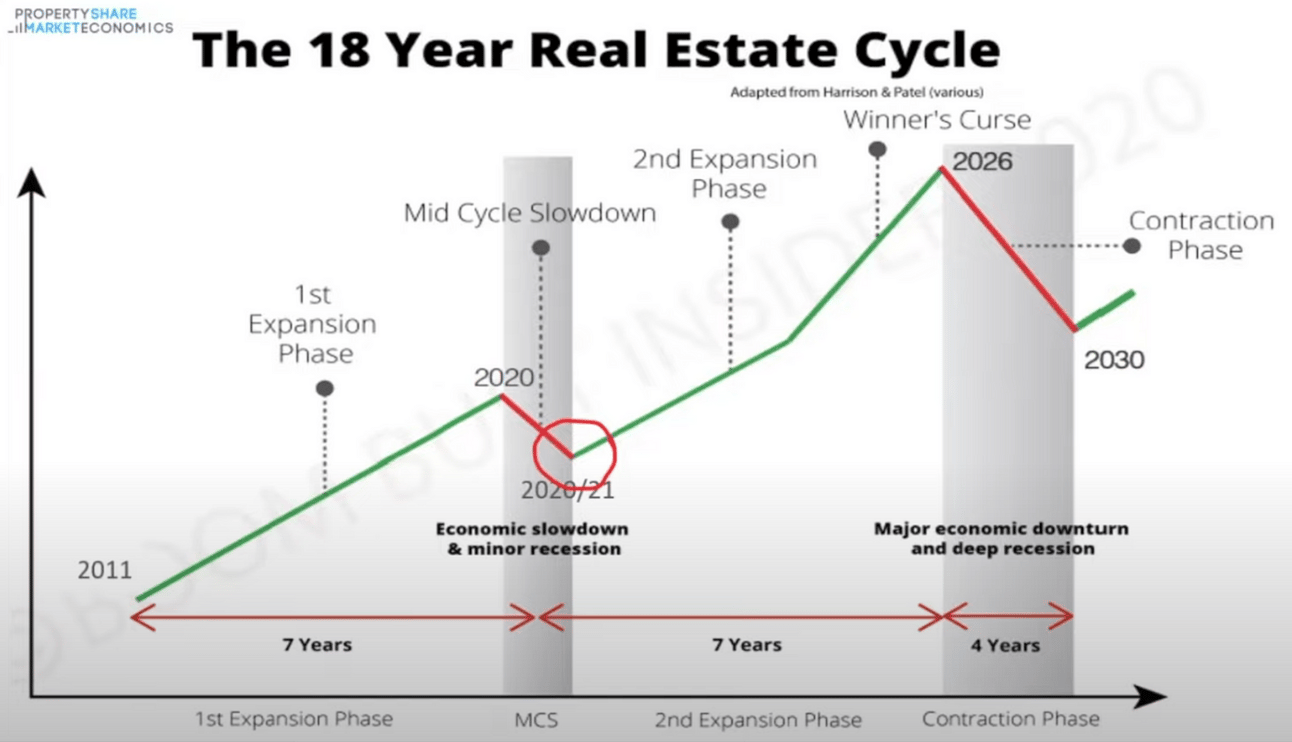

📚 Study Cycles: Read Dalio. Understand Kondratieff Wave, Fourth Turning, and the 18.6 Year Real Estate Cycle. Each framework gives you timing and investment positioning power.

⏳ 18.6 Year Real Estate Cycle: This cycle follows a mid-cycle slowdown and bubble/bust climax. We’re in the late stage of expansion, heading toward the 2026–2028 blow-off top. That’s where land prices go vertical—before the correction. Understand this and position accordingly.

💡 Shift Skills, Not Just Assets: Your income stream is your first weapon. The currencies of tomorrow won’t be fiat—they’ll be attention, capital, skills, and sovereignty.

📍 Go Sovereign: Decentralize where you live, bank, and earn. Learn how to maneuver between systems. One passport is a jail cell when the system collapses.

🏛️ Understand That Power Is Multipolar: The future won’t be U.S.-centric. It will be globally decentralized – financially, technologically, and militarily. Bet on systems, not just nations.

Relevance to Markets Right Now

All these principles matter now more than ever. Every major crisis—from 1971 to 2008 to 2020—was followed by one thing: massive stimulus. And every stimulus pushed the system into another bubble.

So when the next global crack happens—and it will—remember Dalio’s rule:

📌 When central banks print big, buy assets. Stocks. Crypto. Gold. Real estate. Don’t sit in cash. Paper money dies last.

What You Need To Do Now

🎯 Audit your life like you would a country’s balance sheet. Are you spending more than you earn? Earning in a depreciating currency? Depending on a fragile system?

🏗 Build leverage, not in debt—but in network, knowledge, income, and sovereign infrastructure.

📖 Study history. Always. Because the fastest way to conquer the future is to see what’s already happened.

Final Note

Most people either overestimate how much time we have, or they think it’s already too late—they’re both wrong.

We are in the late stages of the current American-led order. The systems are fracturing, but the peak hasn’t fully collapsed. This is the window. This is the cycle point where legends are made.

All I can say is: you’d better start thinking exponentially. Understand the trends, read the signals, move with precision. Fortune favors those who stop reacting and start anticipating.

Until next time, move strategically.

Reply